e filing income tax malaysia

As per the Income Tax Act whatever professional tax an individual has paid during the last year is. A qualifying expected tax refund and e-filing are required.

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

ORANG RAMAI DIALU-ALUKAN UNTUK MENYERTAI KONSULTASI AWAM DENGAN HASiL.

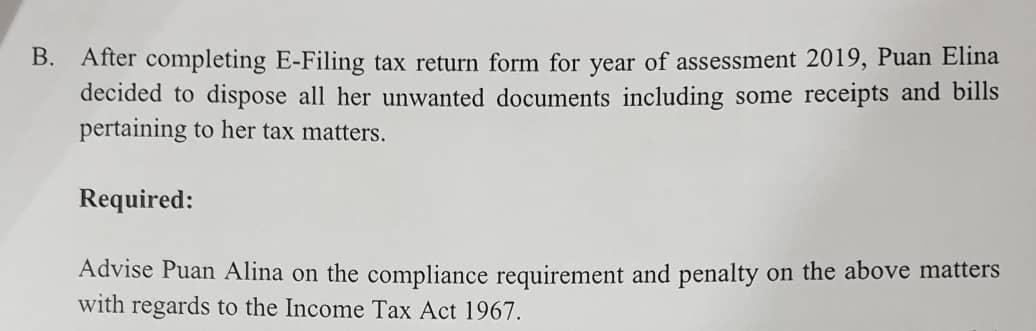

. You can file your return and receive your refund without applying for a Refund Transfer. Type Of Offences Provisions Under ITA 1967 Amount Of Fine RM Fail to furnish an Income Tax Return Form. Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing.

As a result it has become very convenient for individuals and businesses to pay their taxes online file returns and finally track their payments history through the various Income Tax. E-Filing Income Tax Return TDS return AIR return and Wealth Tax Return can be completed online on httpsincometaxindiaefilinggovin. E-filing or online filing of tax returns via the Internet is available.

Meanwhile for the B form resident individuals who carry. Additional fees apply for e-filing state returns. The tax is required to be paid before the filing of the updated tax return and proof to that extent is required to be attached while filing the updated return.

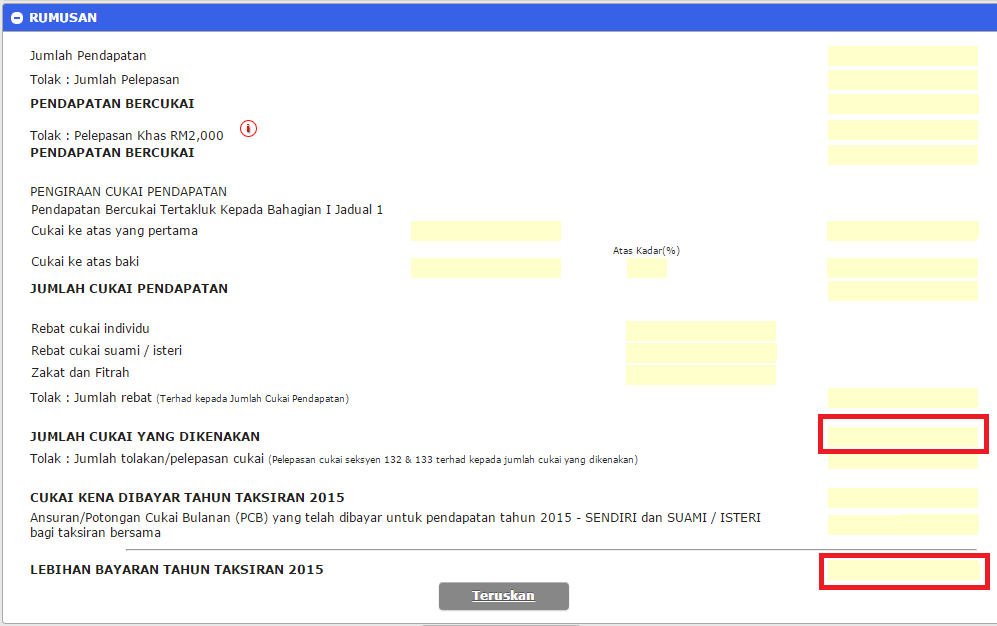

If you use e-filing to file for your tax returns you will be able to see the tax due for each individual and compare it with the joint assessment. Taxable income Tax payable on this income. 1121 200 to 2000 or imprisonment or both.

Payments you authorize from the account associated with your Refund Transfer will reduce the net proceeds of your refund sent to you. According to Section 45 of Malaysias Income Tax Act 1967 all married couples in Malaysia have the right to choose whether to file individual or joint taxes. Must contain at least 4 different symbols.

In 2007 this was 5350 for those filing individually and 10700 for married filing jointly. The companyLLP must have a paid-up capital of ordinary sharescapital contribution not exceeding RM25 million at the beginning of the basis period for the year of assessment the tax rebate claim is made. If you rent real estate such as buildings rooms or apartments you normally report your rental income and expenses on Form 1040 or 1040-SR Schedule E Part I.

Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees. Since this donation is limited to 10 of his aggregate income he can claim RM6000 10 x RM60000 in tax deductions. Personal exemption is a tax exemption in which the taxpayer may deduct an amount from their gross income for.

The tax return is deemed to be a notice of assessment and is deemed served on the company upon the date the tax return is submitted. As per the Press Release on June 2021 tax exemption has been provided to persons who have received money for COVID medical. Particulars required to be specified in the return include the amount of chargeable income and tax payable by the company.

There is no ceiling in monetary terms in the Income Tax Act in article 276 of the Constitution. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing.

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. Bagi meningkatkan ketelusan dan penglibatan awam dalam pentadbiran cukai langsung Lembaga Hasil Dalam Negeri Malaysia HASiL mengalu-alukan orang ramai untuk menyertai Konsultasi Awam. The income tax slab and rates for FY 2021-22 is important as it is needed to calculate income tax amount while filing ITR this year and the income tax slabs and rates for FY 2022-23 is need to know how much tax.

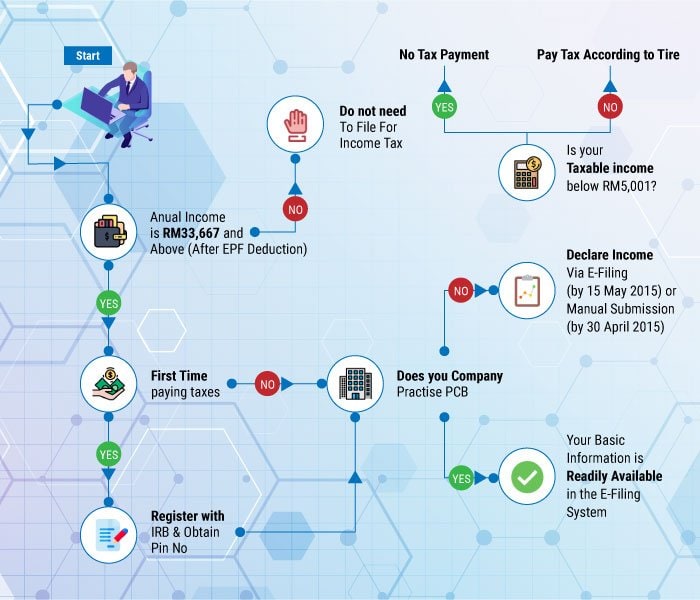

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. Any State Government is not eligible to impose more than Rs2 500 annually as professional tax. Filing your tax through e-Filing also gives you more time to file your taxes as opposed to the traditional method of filing where the deadline is usually on April 30.

Final income tax liability inclusive of cess-304200. Cess at 4 on total income tax payable ie. Savings and price comparison based on anticipated price increase.

If this is your first time filing your tax through e-Filing dont worry weve. Thus his chargeable income after taking the tax deduction for his donation into account is RM60000 RM6000 RM54000 thus lowering the amount of tax he has to pay. List your total income expenses and depreciation for each rental property on the appropriate line of Schedule E.

Tax relief on COVID-19 treatment expenses and compensation. TurboTax CDDownload Products. Refund Transfer is a bank deposit product not a loan.

You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. E-filing your return has obvious advantages like the fact that you wont have to deal with the hassle of paperwork and waste time sorting through it all. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

You can simply log on to the. E-file fees do not apply to New York state returns. The companyLLP must be incorporated or registered in Malaysia and is a tax resident for tax purposes.

This way you will be able to see. Refund Transfer is a bank deposit product not a loan. 6 to 30 characters long.

Payments you authorize from the account associated with your Refund Transfer will reduce the net proceeds of your refund sent to you. Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. E-Filing Income Tax.

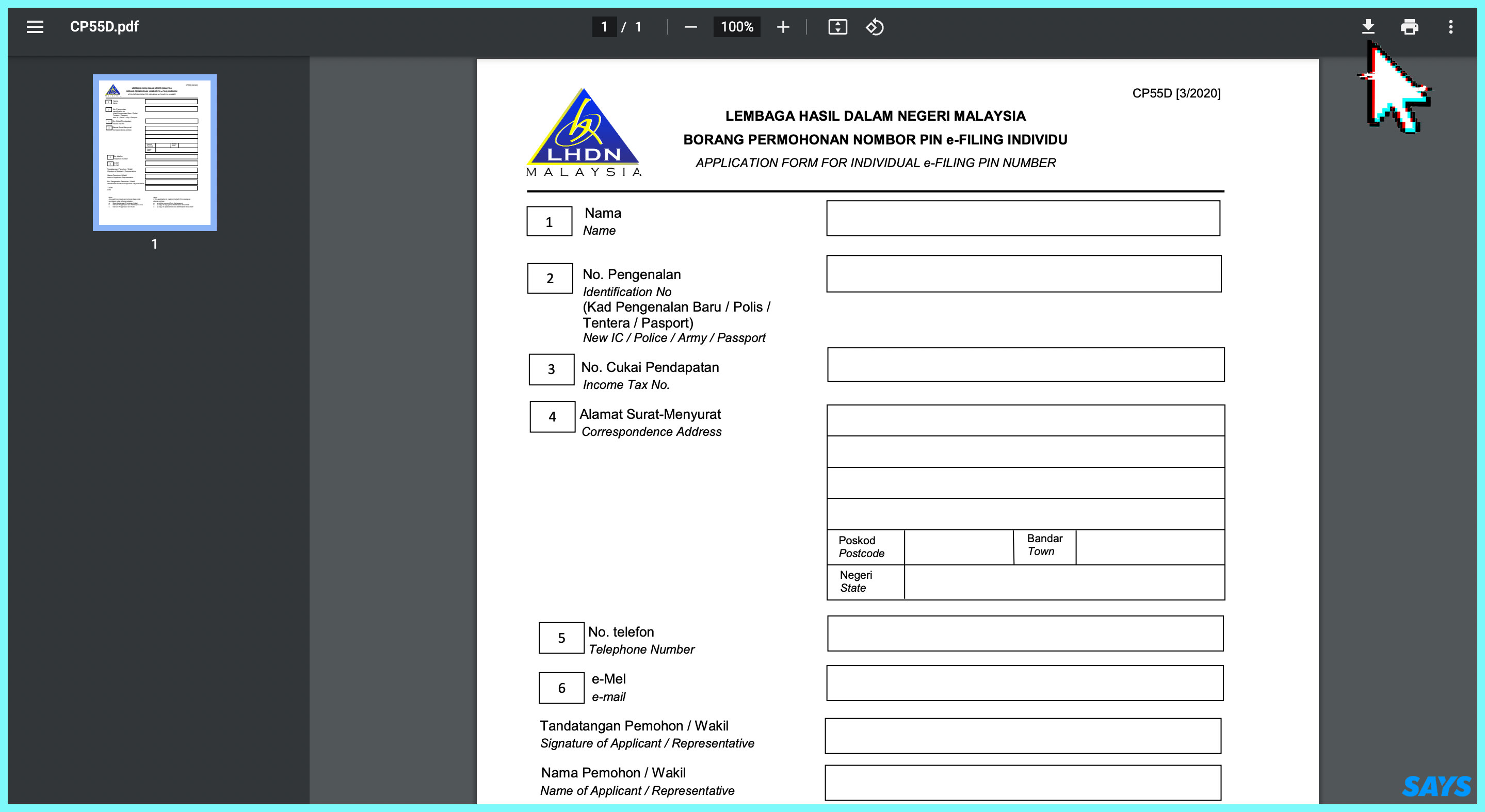

Before you can complete your Income Tax Returm Form ITRF via ezHASiL e-Filing the first step you have to take is to Register at ezHASiL e-Filing website. Malaysia has the following income tax brackets based on assessment year. ASCII characters only characters found on a standard US keyboard.

A qualifying expected tax refund and e-filing are required. You can file your return and receive your refund without applying for a Refund Transfer. Over the past few years the income tax department of India has digitized the entire Income Tax Collection and return filing process.

Please bear in mind that you must be registered as Taxpayer prior to registering for ezHASiL e-Filing. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources.

Income Tax Filing Malaysia E Filing And Corporate Tax Return

Guide To Using Lhdn E Filing To File Your Income Tax

How To File Income Tax In Malaysia Using E Filing Mr Stingy

Dateline To Submit Tax Return Forms And Payment For Balance Of Tax For

Business Tax Deadline In 2022 For Small Businesses

Ctos Lhdn E Filing Guide For Clueless Employees

Electronic Filing Of Personal Income Tax Returns In Malaysia Determinants And Compliance Costs Semantic Scholar

Question 1 A Brian A Canadian Engineer Took Up An Chegg Com

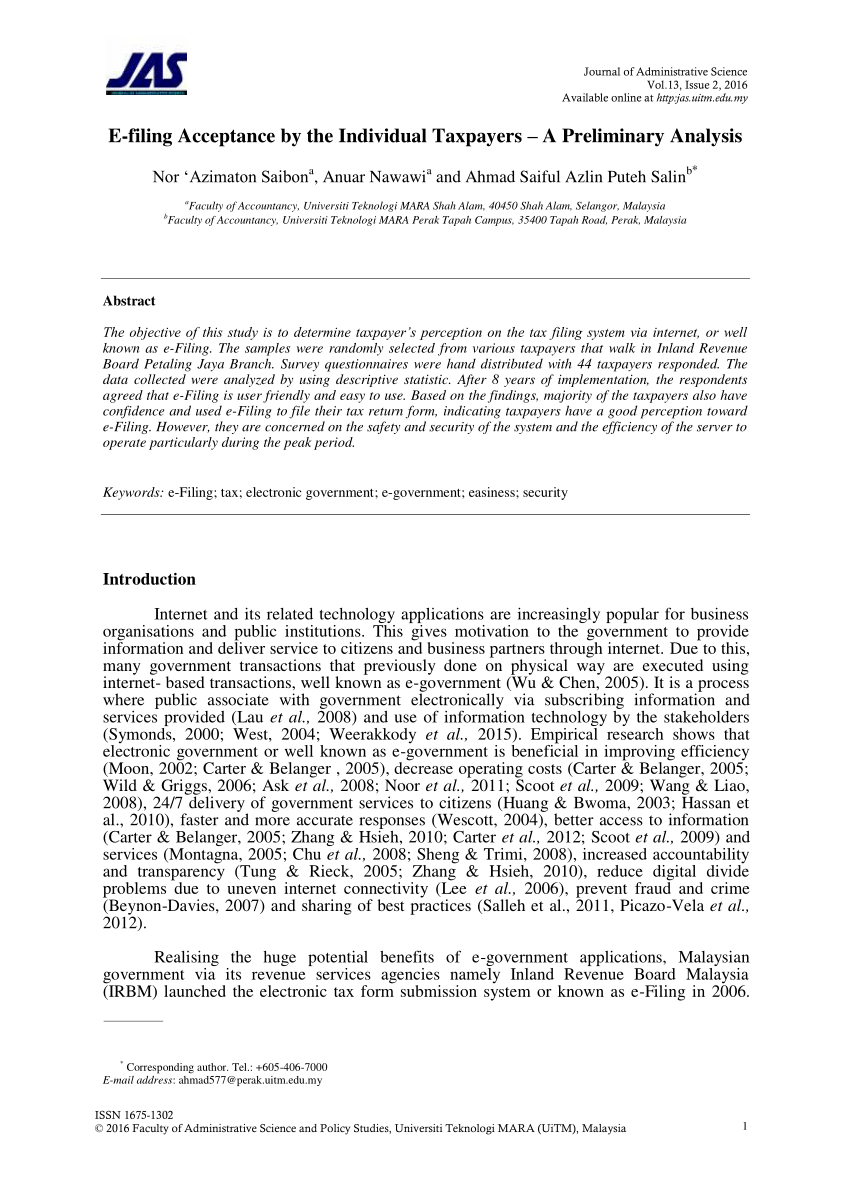

Pdf E Filing Acceptance By The Individual Taxpayers A Preliminary Analysis

Electronic Filing Of Personal Income Tax Returns In Malaysia Determinants And Compliance Costs Semantic Scholar

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

How To Step By Step Income Tax E Filing Guide Imoney

9 Income Tax Ideas Income Tax Income Tax

What Are My Responsibilities As A Taxpayer Tax Lawyerment Knowledge Base

Pdf The Compliance Time Costs Of Malaysian Personal Income Tax System E Filers Vs Manual Filers

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

How To File Income Tax For The First Time

Deadline For Filing Of Employer S Return Of Remuneration Malaysian Taxation 101

0 Response to "e filing income tax malaysia"

Post a Comment